In these states, mistake is not appropriate in identifying who need to pay for bodily injury responsibility after a mishap. Injury damages are covered by your very own insurance company, regardless of that is at mistake for a crash. No-fault states still require motorists to buy residential or commercial property damages responsibility, as well as many also call for that you carry bodily injury obligation insurance coverage as well (insurers).

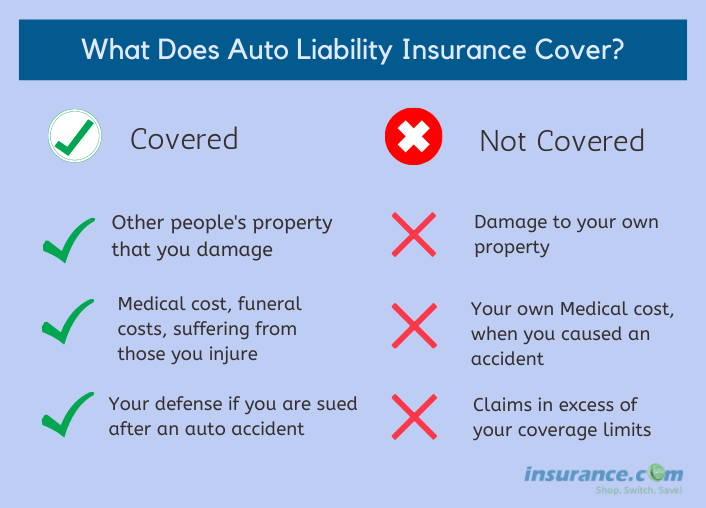

This choice is made when you purchase or restore your auto insurance plan. What responsibility cars and truck insurance does not cover Responsibility vehicle insurance does not cover problems to your very own vehicle and individual after a crash. If you want your insurance provider to cover these problems, you will require accident as well as medical insurance coverage.

Liability insurance coverage will certainly not pay for residential property problems as well as medical costs for the various other driver if you are not liable (cheapest car insurance).

Automobile obligation insurance protection helps cover the expenses of the various other motorist's home and bodily injuries if you're found at mistake in a crash. The vehicle obligation protection definition may seem straightforward enough, yet below's a genuine life instance: you're at a four-way stop a couple of blocks from your residence (cheapest auto insurance).

The following point you understand; you have actually wrecked right into one more motorist's vehicle in the middle of the intersection. Your insurance provider will function with the various other vehicle driver's insurer to establish who is at mistake (if you reside in a no-fault state). If you have liability insurance policy, your insurance provider will certainly cover costs for the motorist's broken car, minus your deductible, as well as approximately your protected limit.

The Only Guide to Automobile Liability Insurance - Insurance Glossary Definition

In some circumstances, it might even cover lost incomes and/or legal charges if the victim submits a legal action. Home damages liability protection relates to problems to residential property arising from a protected accident in which you're at fault. It may cover the various other celebration's vehicle fixing or substitute prices, in addition to other residential property that might have been harmed in the accident, such as fencings, structures, phone poles as well as various other types of residential property.

You can decide for a larger amount than the minimum called for by your state, depending on your requirements. Think of liability insurance coverage as the baseline for vehicle coverage - laws.

Car Plan Security Vehicle policies usually give the list below kinds of protection: Bodily Injury Obligation: Pays, as much as the limits of the policy, for injuries to various other individuals you create with your auto. Property Damage Obligation: Pays, as much as the limits of the policy, for damages to other individuals's building brought on by your vehicle.

It will certainly pay for damages to your automobile caused by crash or trouble. Comprehensive: Pays for damages to your vehicle triggered by dangers other then collision or trouble. Various other: There are various other insurance coverage's such as towing and also automobile leasing which might be readily available.

If the rates are fair, adequate, and not excessive or unfairly prejudiced, the firms might utilize them. This permits competition to exist and also enables Indiana people to purchase insurance policy at a fair cost.

The smart Trick of What Does Auto Liability Insurance Cover? That Nobody is Discussing

When contrasting prices, be certain each firm is estimating on the exact same basis. The least costly plan is not constantly the very best plan. Some rating elements insurance coverage companies might utilize are: Age and Sex Marital Condition Vehicle Driver Record Cars And Truck Use Place of Residence Policy Purview Deductibles Kind Of Cars And Truck Driver Training Insurance Claims History Credit Report Cancellation or Non-Renewal Limitations Insurance policy companies should comply with particular guidelines to cancel or non-renew an insurance coverage plan in Indiana.

What happens if I trigger a crash and https://storage.googleapis.com also the other vehicle driver makes a liability insurance coverage claim in Ontario? In the event that you remain in a mishap, regardless of who is at-fault, both celebrations will require to fill out a crash record and submit an insurance claim with their particular insurance companies.

insurance car insured cheaper auto insurance auto insurance

insurance car insured cheaper auto insurance auto insurance

car cheap car insure low-cost auto insurance

car cheap car insure low-cost auto insurance

Should you really feel that the judgment was wrong as well as disagree with it, you can oppose the decision by bringing the matter to your insurance policy business's grievance policeman or to court - prices. Courts or arbitartors typically will certainly make the liability rulings if the insurance coverage companies do not concur.

It is necessary to keep in mind that responsibility insurance coverage is obligatory by legislation in nearly all states in the U.S. The minimum quantity motorists are needed to carry differs from state to state (insure). When selecting coverage, it's vital to keep in mind in an at-fault crash where the prices associated with injuries and also building damage are higher than the picked insurance coverage limits on your policy, you are responsible for paying costs that surpass the limits on your plan.

It's typically recommended to have even more than the state's minimum obligation coverage. Normally having enough responsibility coverage to protect properties in the case of a significant accident is advised.

Unknown Facts About Minimum Auto Insurance Requirements - Department Of ...

It additionally usually covers damages triggered to your car and may cover some medical expenses sustained as a result of a mishap. To locate out more about MAPFRE's liability coverage or complete protection, talk with an independent representative. If you currently know what sort of insurance coverage fits your requirements, see if you might be reducing your vehicle insurance in Massachusetts by switching over to MAPFRE Insurance policy.

Liability insurance is an automobile insurance plan that covers other individuals as well as their home when you trigger a crash. It's made up of 2 types of obligation insurance that are typically marketed with each other: Physical Injury insurance and also Property Damage insurance (car insurance). Property Damages responsibility covers problems you trigger to another person's residential or commercial property.

(If you drive your vehicle into the side of a person's barn, Home Damage obligation insurance coverage would certainly pay to have the barn wall surface taken care of.) Physical Injury responsibility spends for other individuals's injuries after a mishap you cause. For instance, if you triggered a crash which sent out 2 people to immediate treatment, Physical Injury insurance coverage would certainly pay for their hospital bills and also any kind of medication they needed later.

Injury Protection gives you with wage loss, survivor benefit and also clinical insurance coverage regardless of fault. A. You might additionally buy thorough and accident insurance coverages (vehicle insurance). Comprehensive protection safeguards versus damage to your car from acts of nature or various other occasions not related to operating the automobile. Crash coverage shields versus damages to your car when it is involved in a mishap.

cheaper car insurance insurance prices

cheaper car insurance insurance prices

Yes, the College Graduate Discount as well as Defensive Driver Discount for those insureds 55 and also over that have effectively finished a program authorized by the Office of Chauffeur Solutions. Contact your agent for any various other discounts your insurer might supply - insurance. A. Most likely due to the fact that the insurer enhanced its total prices due to the fact that it has paid more losses than expected.

Little Known Questions About What Is Liability Car Insurance? - Policygenius.

This can differ by company. You need to ask your representative if your policy covers you, those you might wound if at mistake, as well as the rental agency's auto. You are not called for to have home owners insurance coverage by any kind of Arkansas law.

Your lending organization may have even more info on what levels of insurance coverage it needs you to maintain. There are numerous different kinds, yet most homeowners carry full coverage for all hazards consisting of losses linked with any type of unexpected as well as unintentional occasion.

Other kinds of homeowners insurance policy cover just fire and also climate occasions. Some are designed especially for renters. A (cheaper car). An insurance coverage firm might utilize credit report AS PART of the procedure of figuring out whether insurance coverage will certainly be supplied and what it sets you back. A Customer Sales brochure on use credit report in house owners as well as individual auto insurance policy is currently offered.

A ranking figured out by the equipment, workforce, water source as well as various other variables of a fire area. Classifications vary from 1 to 10, with 10 being a very rural location with extremely little fire security., or ISO, inspects neighborhood fire divisions and also sets the classification - cheap auto insurance.

We have broad authority to assess just how the rate is distributed amongst insureds according to aspects that may anticipate future losses, but A rate ends up being extreme when the loss proportion (losses separated by premiums paid) drops to a factor which causes the insurance provider earning a too much amount of profit.

All About What Is Liability Car Insurance? What Does It Cover?

A. It is a wellness condition you had prior to you bought your medical insurance protection, such as cancer, despite whether you got a medical diagnosis or treatment before the acquisition. Wellness service providers can sometimes refuse to cover your pre-existing problems. A. There are several scenarios in which your health service provider can decline to cover your pre-existing problems.

23-86-310. If an individual has actually protection, complied with by break of 63 days, that previous insurance coverage does not count as worthy coverage! To illustrate, suppose an individual had protection for 2 years complied with by a break in protection of 70 days and afterwards returned to insurance coverage for 8 months. That person would only get debt for 8 months of protection; no credit scores would be given for the 2 years of protection before the break in coverage of 70 days.

We can check to ensure that both the insurance carrier and producer offering it are correctly accredited. Right here are a few other threat indicators: Be cautious if a qualified insurance coverage representative tries to market you wellness coverage that claims to be an ERISA plan. Be doubtful if the plan provides coverage without pre-existing condition exemptions - cheapest auto insurance.

Medical insurance business, consisting of HMOs, have thirty day to pay a case to either you or your clinical supplier, if the insurance claim is electronically filed with the medical insurance business. cheap car insurance. If the insurance claim is sent by mail to the health insurance coverage business, the medical insurance company has forty-five days to pay the insurance claim.

If the insurance claim is nonetheless not "clean" or the health insurance company needs more details to refine the insurance claim, the health insurance firm is permitted 1 month to collect the info, as well as after all of the called for info is obtained by the health insurer, the 30 (digital) and also 45 (non-electronic) day settlement regulations after that apply - insurance.

How Consumers Faq - Arkansas Insurance Department can Save You Time, Stress, and Money.

cheap insurance cars car insurance affordable

cheap insurance cars car insurance affordable

No, it is not mandated by the Arkansas Insurance Policy Department - automobile. Difficulty of Pregnancy is a covered advantage. In employer teams of greater than 15 employees, Title VII of the Civil Liberty Act of 1964 states that any kind of wellness insurance coverage supplied should cover costs for pregnancy-related conditions on the exact same basis as costs for other medical problems.

A. Yes, state extension is for 120 days as outlined under ACA 23-86-114. You can call your health and wellness service provider or the Arkansas Insurance Department. A. Your wellness carrier will certainly provide you this info in your policy as well as after your claim is denied.

Individuals or corporations may protect insurance protection directly from a non-admitted insurance firm. This protection is taken into consideration "self-procured." Your agent can aid you if surplus lines protection is required. Surplus lines insurance is regulated by Regulation 24 - insure. A. We do not. Federal as well as State Financial institution regulators do that, along with united state. The regulation is found at Ark. Code Ann. 23-79-103 (for insurance coverage passions in individuals) and also 23-79-104 (for insurance coverage passions in home). A. The valued policy legislation, Ark. Code Ann. 23-88-101, covers losses on real home, such as a house, from fire as well as all-natural catastrophes. Basically the valued plan law says that, absent an insurance firm defense such as arson or various other insurance scams, the insurance provider for an overall loss on actual property owes the complete face quantity (total policy price in $ bucks) of the policy without devaluation or objecting to the value.